'Perfect storm' batters electronic component supply chains especially semiconductors

Electronic component supply chains, especially semiconductors, were under strain even before the pandemic; COVID-19 broke them in many places. Now, with the global vaccine rollout underway and production of electronic devices continuing to increase, the demand for electronic components is soaring – and supply chains are not able to meet the need.

We have all seen the news, automotive manufacturers shutting down for a week, increasing cost of gaming machines and the launch of the Apple iPhone 12 was delayed by a couple of months all due to the lack of semiconductors.

So, what is going wrong, and why is there a global crisis affecting the semiconductor market and generally the electronic component arena? Demand for components is skyrocketing simultaneously in almost every industry, including the smartphone, automotive, medical, and IoT markets. Gartner predicts the IoT market will grow by six times from 2018 ($212bn) to 2026 (£1,319bn). And every IoT product needs sensors and other electronic components. Global semiconductor industry sales were $40 billion for January and increase by 13% year on year, according to the Semiconductor Industry Association.

The answers to the supply conundrum are being questioned by politicians, customers, and investors. The simple answer is the world cannot make the volume of semiconductor devices and other components that the electronics market currently requires.

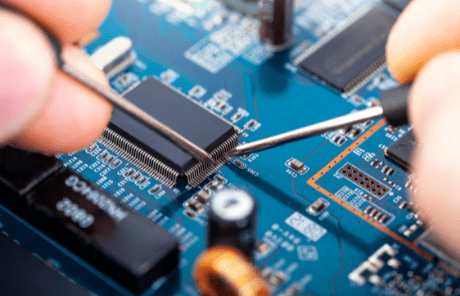

Manufacturing semiconductors, especially digital semiconductors with trillions of transistors is a very complex and expensive business. They can take a couple of months to completely manufacture, package, and test and years to design, but more importantly, it requires billions of dollars of investment in semiconductor fabs to physically manufacture the devices.

The major semiconductor manufacturers such as Intel, Samsung, and TSMC (Taiwan Semiconductor Manufacturing Company - the largest semiconductor foundry), estimate it costs in the region of $10-20 billion to build a new wafer fabrication facility (wafer fab). This also assumes you have the complex semiconductor process technology working correctly to then start the manufacturing process and achieve the high yields required to cover the cost of manufacturing and make a profit. Each fab needs to make at least $3B profit in under five years, as the plant and equipment then become obsolete.

Semiconductor plants or fabs run 24 hours a day, seven days a week to try a maximise the return on investment. TSMC announced in April 2021 that it plans to spend $100 billion on new production facilities as well as R&D over the next three years. The world's largest contract manufacturer of semiconductor chips says that its fabs are currently working at full capacity, so to meet the demand for its services going forward it will need much more capacity.

So, the challenge for countries and companies is how do you become semiconductor self-sufficient, or partially, when fewer and fewer companies can take the gamble associated with such large and highly risky investments. China’s 14th Five-Year Plan (2021-2025) has a spotlight on semiconductors. China sees semiconductor capabilities and supply as intrinsically linked to its economic and national security, a conviction that has sharpened in recent years as U.S. policy has taken aim at Chinese supply chain vulnerabilities.

Some businesses are still prepared to take the risk because of the tremendous volumes, PC shipments reached 275 million units in 2020 and 1.4 billion smartphones were sold each containing many semiconductors often manufactured by TSMC for its many semiconductor customers/partners. Intel dominates computer processors and Samsung memory and processors. These three companies generated combined sales of $188 billion which is almost as much as the next twelve largest semiconductor companies combined and many are very large companies already, such as SK Hynix at $26 billion sales in 2020.

The issues go well beyond COVID, large sums of capital investment, climate change putting stress on fabs and manufacturers in some countries, and factory fires in facilities that were critical to the manufacture of specific components. Suppliers are working around the clock trying to keep up with demand, but global capacity is the main issue.

This dependence is not only causing immediate supply chain issues which are likely to continue for at least six months, which is now focusing on policymakers’ minds such as the Biden administration. The US President recently stated that “The American people should never face shortages in the goods and services they rely on. We need to sharpen America’s competitive edge by investing here at home”. To that end, he has created a 100-day supply chain review of semiconductor manufacturing, advanced packaging, critical minerals, medical supplies, and high-capacity batteries.

The next item on the agenda for US companies building fabs is likely to be tax credits, funding initiatives, loan guarantees as the US tries to regain control of semiconductor manufacturing from Asia. Current predictions have Asia dominating semiconductor manufacture by up to 80% by 2030.

So, with semiconductors becoming the key technology enabler and backbone for many industries including, automotive, EV, 5G wireless to power generation one may wonder what other governments, especially in Europe are going to do to ensure they have continuity of supply.

How can Redline help your business?

At Redline Group, we have a team of consultants, focused on knowledge-led recruitment within the high-tech and semiconductor sector. We’re able to deliver talent acquisition strategies in contract, interim, and permanent recruitment. If you would like to find out more, contact us today on Info@RedlineGroup.com.